Table of Content

GE McKinsey Matrix

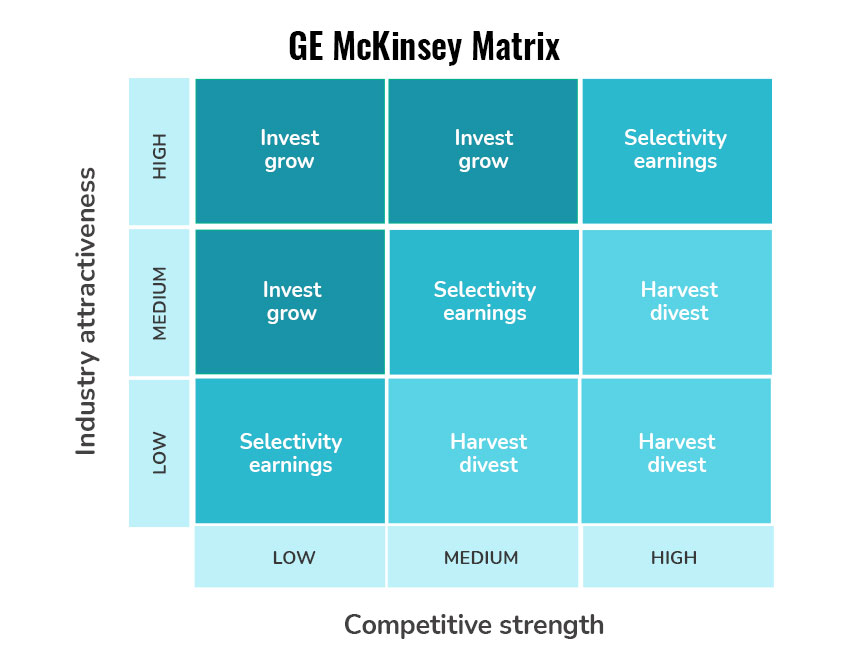

General Electric Matrix was given by McKinsey in 1970 to manage a large and complex portfolio of strategic business units. This model was developed when General Electric engaged McKinsey and Company to help companies take strategic decisions at the corporate level. The strategic planning tool helps the organization to prioritize its investment in different business units by considering three possible scenarios which include protect, harvest, and divest. It consists of the Nine-cell Matrix that considers the industry attractiveness as well as business strengths while proposing and guiding various business strategies. You also need to consider that it is one of the good alternatives to the BCG Matrix as the two factors i.e. industry attractiveness and business strengths considered in this Matrix consist of various multiple factors which help to make the best decisions.

The need for the GE McKinsey Matrix

GE-McKinsey Nine-box Matrix helps to take the best strategic decisions by considering various strategic options available to the organization to get maximum from its business units. The use of this Matrix also helps to evaluate various types of the business portfolio and make the best decision. This model also helps to maximize results with little effort and prioritize various investment decisions in a systematic manner. The industry attractiveness is measured on the basis of the market size, market profitability, pricing Trends, risks, market segmentation, opportunities to differentiate the products and services, entry and exit barriers, long-term growth potential, bargaining power of the suppliers and buyers in the industry, etc. The competitive strength in the industry is also evaluated on the basis of a number of factors which include market share, market growth potential, brand awareness, customer loyalty, product uniqueness, profit margins of the business, relative cost position, technological advancement, distribution strength, etc. Thus, the organizations can use this Matrix in place of the BCG Matrix as it involves better judgment of the strategic decision making as much more information is used in this Matrix when compared to the BCG Matrix which also helps to establish a strong competitive position of the business in Industry.

How to apply the GE McKinsey Matrix?

GE-McKinsey Nine-box Matrix can be used by considering the industry attractiveness and strengths of the product and business unit. The industry attractiveness can be determined by considering the industry size, profitability, environmental factors, pricing and labor requirements, etc. The industry attractiveness is plotted on the vertical axis which includes measures of industry attractiveness as high, medium, and low. The higher industry attractiveness represents higher profitability which then encourages the other firms to enter the industry.

After considering the industry attractiveness, the competitive strength of the product and business unit is evaluated by analyzing the market share, average profitability, strength of the brand, customer loyalty, etc. This segment is plotted on the horizontal axis of this Matrix which is also segmented into three categories i.e. high, medium, and low.

After evaluating industry attractiveness and competitive strength, each strategic business unit is placed in the matrix which then helps to determine the strategic possibilities for each SBUs. The diagonal line can also be drawn from corner to corner from low strength to high industry attractiveness. The organization can invest more in the SBUs above the diagonal line whereas the organization can divest from or provide lower funding to SBUs that are below the diagonal line. Thus, the organization can increase or decrease the investment on the basis of the position of each strategic business unit.

GE-McKinsey Matrix real example

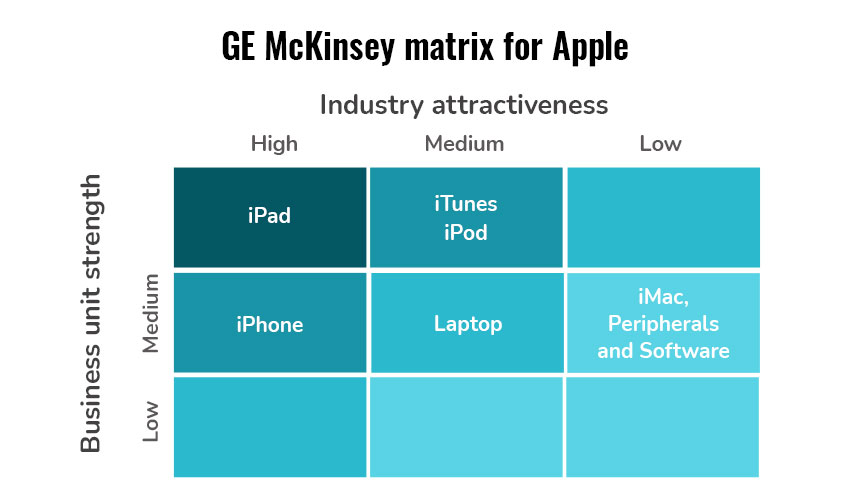

Probing further, let us highlight the Apple GE-McKinsey Matrix for practical understanding. The different product lines of Apple include iTunes, iPod, iPad, iPhones, laptops, desktops, and iMac.

To prepare this Matrix, we first need to consider the industry attractiveness for different strategic business units. The industry attractiveness for smartphones and iPad is very high due to increasing demand for these products, lower bargaining power of the customers, higher profitability, product differentiation, etc. Different features such as long-lasting batteries, high-speed processors, large screens, etc. are also influencing the demand of tablets and smartphones. However, the industry attractiveness for iMac, iTunes, and iPod is generally medium as there is a lack of product differentiation in regard to these products and the number of competitors in the market for laptops, online music streaming apps, etc. is rising. The global laptop market is also growing only at the CAGR rate of 0.4% as increasing sales of smartphones are restraining the growth of the laptop market.

Now, let us consider the company strengths to position each strategic business unit and product in the GE McKinsey Matrix. Apple has achieved a leading position in the smartphone market due to higher product innovation and uniqueness. Apple iPhone 12 also has been recognized as the world’s bestselling 5G smartphone due to mmWave support features, premium product features, etc. The Apple iPad also dominates the global tablet market and has grabbed 37 % market share in the first quarter of 2021. The impressive sales boost of Apple iPad is the result of the remote working conditions and uniqueness of the product.

We all know that the demand for laptops is also rising in the current times but the presence of a large number of competitor firms has resulted in wider choices being available to the customers. iMAC enjoys medium competitive strength in the market as, despite recent developments and innovations, Mac market share accounts for only 8.5 % in the industry. However, Apple iTunes and iPods enjoy a strong competitive advantage in the market as iTunes and the iPod revolutionized the whole music industry, and around 72 million individuals subscribed to Apple Music by the end of June 2020.

On the basis of the above analysis, the GE McKinsey Matrix for Apple is prepared as follows-

Now, the organization can also engage in strategic planning considering the position of each line of the product to invest in the most profitable areas. The company should invest in IPad, iPhones, Apple iTunes, and iPods as all these products fall in the growth investment area. The higher growth potential of the organization also helps to ensure higher returns of the organization which also supports that Apple should invest in all these product areas. However, Apple needs to hold the iMac product line as the position of this business unit is ambiguous and the future growth of this product is unclear. The company also needs to increase sales of iMac by improving customer loyalty, increasing investment in advertisements, etc. Hence, the use of this strategic model can help the organization to consider the current position of its strategic business unit and plan future growth strategies.