Table of Content

Introduction to BCG Matrix

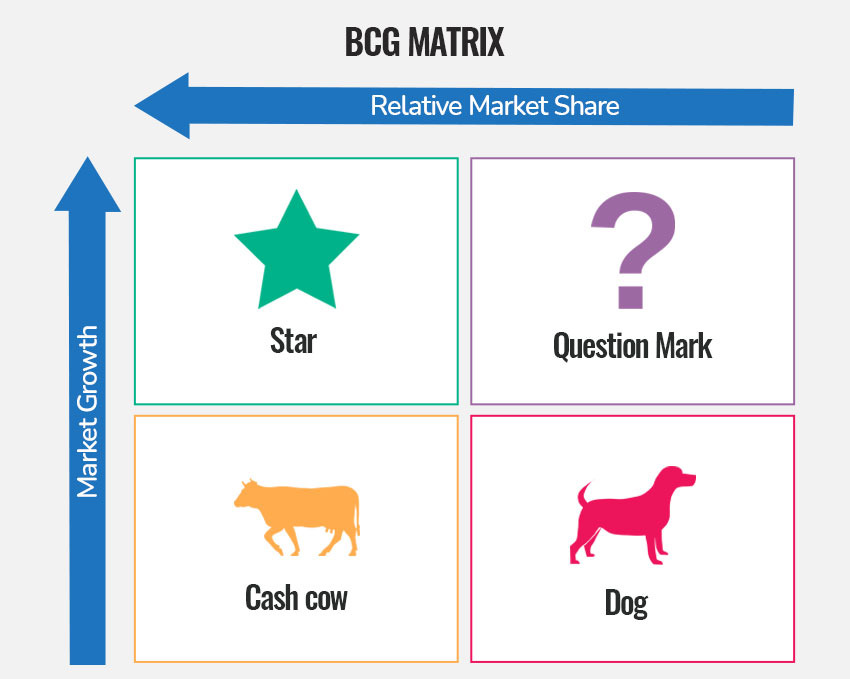

Boston Consulting Group’s Growth and Market Share Matrix is one of the important strategic planning tools that can be used by the organization to provide a graphic representation of the products and services of the organization and to decide what the organization should own, sell and invest in. This Matrix is mainly used by the management team of the company to assess the current state of the product and service offering of the company. This is also known as the Growth/ Share Matrix as this Matrix has the four-quadrant based on analysis of the market growth and market share. In this Matrix the product or service offering of the company are plotted in four different categories which include "Dogs," "Cash Cows," "Stars," And “Question Marks.

The need for the BCG Matrix

The BCG Matrix is used to assess the current state of the product lines and service offerings of the organization. By using this model, the organization can also determine the product lines that the organization should keep, sell and invest in. The use of this strategic planning model can also help the organization to better allocate the resources across its business units. This model is mainly used by large-scale organizations that have diversified product portfolios and need to assess the market share and growth prospects of different product lines. In addition, the BCG Matrix also provides a view on the available opportunities for the current product portfolio by understanding which business should the company invest in, which business needs harvesting, which business needs to be completely shut down, and which business needs divesting.

How to apply the BCG Matrix?

Before moving on to the real example of BCG Matrix, let us discuss How to use the BCG Matrix for strategic planning?

To use the BCG Matrix, the organization first needs to review the portfolio of the products, services, and strategic business units of the organization. Then, the organization needs to prepare the BCG Matrix template and consider the four different quadrants covered in the BCG Matrix. The four different quadrants include "Dogs," "Cash Cows," "Stars," And “Question Marks.

- The “Stars” category depicts the products or brands that have fantastic opportunities and can generate higher ROI due to higher market share, growth market, and cash generation capacity. The strategy that can be adopted by the organization for this category of products is to hold these products and invest in the marketing of these products to ensure higher market share and growth.

- The “Question marks” category includes the products that can attain higher growth but currently, the market of such products is uncertain – whether it will grow or decline. Also, the cash used in this category is high due to higher market growth, lower market share, etc. The key strategy available to the organization, in this case, is to build in the manner that helps to transform the new entry products into the higher market share products.

- The “Cash Cows” category includes products that are well-established and consistently produce cash through a higher market share in the low growth markets.

- The last category includes the “Dogs” category which includes the products that have little or no value as these products have low market growth as well as low market share. These products do not generate higher cash and thus, do not require higher investment. Thus, the key strategy that can be adopted for these products is to divest the product altogether or improve the product demand through innovation and rebranding.

After considering all the four quadrants, the organization needs to list and allocate its products on the basis of the market growth, market share, and cash generation or usage factor. After proper allocation of the products, the organization can then determine the strategies that can be adopted by considering the products that need investment and that need to be diversified.

BCG Matrix real example

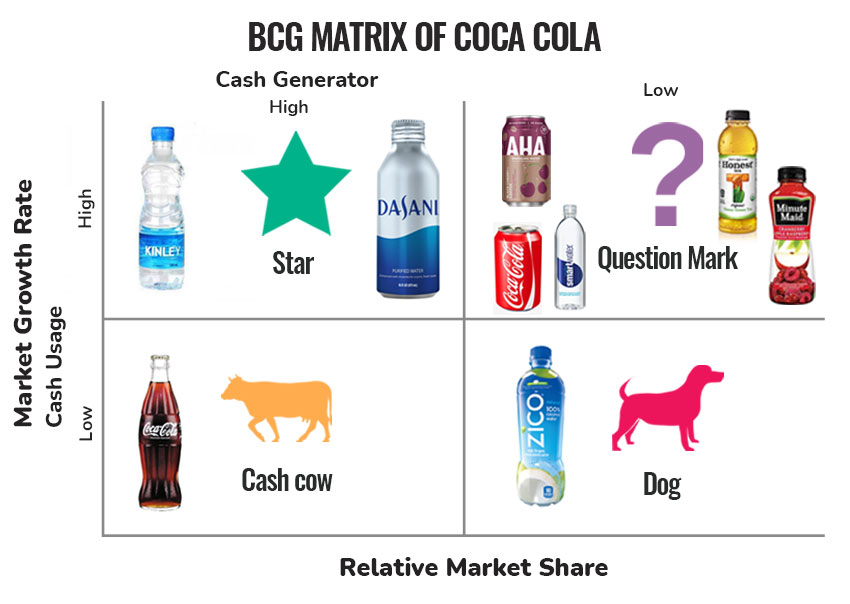

Coca-Cola is an American MNC that has a product portfolio of more than 3500 beverages under 500 brands. For better understanding, let's prepare the Coca Cola BCG Matrix and see which products of Coca-Cola fall under which quadrant.

Cash Cows

The Cash Cows include a product that is not in the growth industry but delivers a higher market share. Coke has been in the market for years and has achieved a leading position in the market in terms of the carbonated soft drink segment. Coke is also a major revenue-generating product for the company.

Stars

The Stars include the products and business units that attain a higher market share in the high-growth industry. The Kinley and Dasani water of Coca-Cola falls in this category as bottled water is becoming an ever-evolving and demanding product in the international market. Coca-Cola has the opportunity to hold Dasani and Kinley water bottles and invest in the marketing and advertising of these products to ensure higher market share and growth.

Question Mark

The products in the Question Mark category have a smaller market share even in the expanding market. Can you guess any product of Coca that is in the expanding industry but has a smaller market share? Some of these products are Minute Maid, Diet Coke, Smartwater, Sparkling water, Honest Tea, etc. There is huge potential for these products in the market due to rising health consciousness among the customers which suggests that Coca-Cola should either exit these products or invest in advertising, product quality improvement, and other features to ensure higher customer attractiveness.

Dogs

Dogs category includes products that have lower growth potential and do not have a higher market share. Can you think of any Coca-Cola product or brand that is in this category? Maybe not. Have you heard about Zico Coconut Water? Coca-Cola can discontinue this product as this is the least profit-generating product for the company with a very low market share.

Hence, the use of the BCG Matrix provides insight into the current state of the organization's products in the industry which then helps the organization to engage in strategic planning and determine which products the organization should hold, divest, invest or sell.