"Diversification and globalization are the keys to the future"- Fujio Mitarai

Table of Content

Overview

We all know that diversification is an important investment strategy used by organizations in the current times. But do you know that diversification is one of the four main business strategies given by Igor Ansoff? Plus, why do you think that the organizations diversify?

We need to consider that rather than concentrating the money in a single company, sector, industry, or asset class, the business firms are required to diversify their investments across different companies, asset classes, and industries to manage risk. Diversification helps to avoid the risk of having all eggs in one basket.

In this blog, we will present to you the different strategies of diversification and the need for diversification of business firms. The profusion of practical examples in the blog will also help you to acknowledge the importance of diversification in business and the decision-making factors that can be considered to diversify the business.

What is diversification?

We all know that the future is uncertain and the external market factors are amply dynamic with continuous changes that increase risks for the business firms. As a result of this, the organizations are required to employ various strategies and tactics to ensure higher growth and success of the organization. The businesses also diversify their investments among the different companies, industries, or assets to prevent and manage risks associated with the single industry, company, or asset. From this, you must have got a hint about what diversification is.

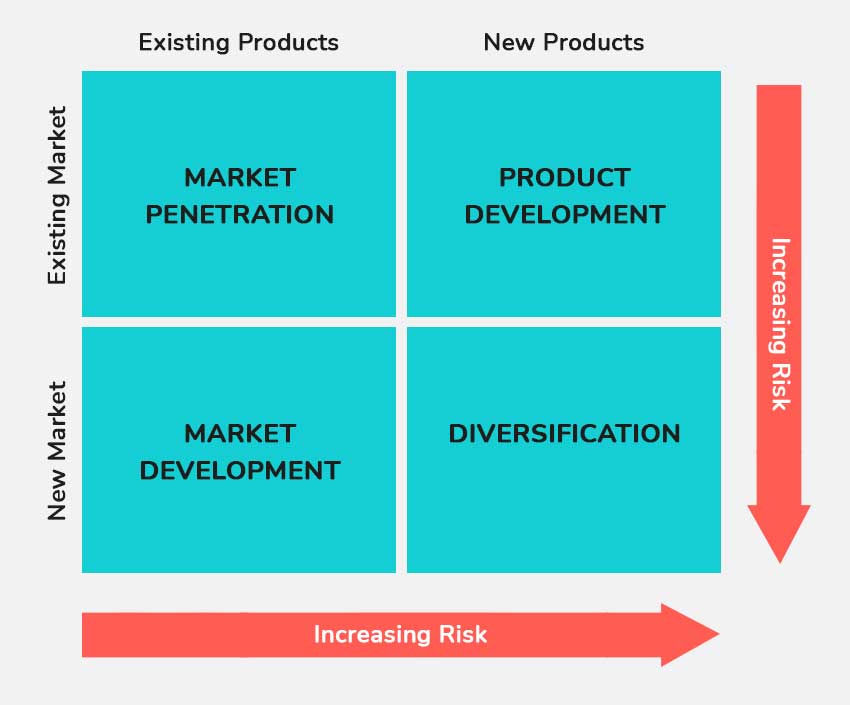

Ansoff Matrix or the product/ market expansion grid is the tool used by firms to analyze and plan the strategies for business growth.

The strategies given under the Ansoff Matrix include Market Penetration, Product Development, Market Development, and Diversification. Thus, diversification is one of these four business strategies that is used by businesses to enter the new markets by introducing new products in the market. In a diversification strategy, the firm enters new markets with new products. Now, you may be thinking that diversification is risky for the businesses as both market and product development are undertaken in this but as we discussed earlier, it helps to diversify the risks across different industries, companies, assets, or even products. Through this blog, you will now get to know about the need and benefits of the diversification strategy for business firms.

Now, you have got to know about the concept of diversification but do you know that diversification can further be classified into two types i.e. related and unrelated diversification. Now, let us discuss the related and unrelated diversification in detail.

What is related and unrelated diversification?

As the term explains, related diversification occurs when there are higher synergies between the existing business and the new product and market strategies. Here, we need to consider that the synergies mean that the business diversifies in a line similar to the existing operations using the existing skills and resources. To better explain this strategy to you, let us discuss the related diversification strategy of Starbucks.

Starbucks is an American multinational chain of coffeehouses that diversified its food menu in 2013 by launching new sandwiches such as Turkey and Havarti sandwiches and Salads such as Hearty Veggie and Brown Rice Salad Bowl.

Starbucks now offers a perfect cup of coffee along with its food menu to ensure higher customer satisfaction. The main aim behind the extension of the food range is to complement their beverages and to enter the new market for meals. Hence, related diversification is launching the new product in the new market similar to the current product range and market.

In contrast to this, unrelated diversification occurs when there are no synergies between the existing business and the new product and market. Thus, it is the riskiest strategy that is adopted by the firms as there is a lack of available skills and resources among the firms to enter the new product line or market. But, do you think there is logic behind the unrelated diversification? Now, let us explain this through some examples.

Do you ever think that a Soft-drink company can buy a movie studio? Definitely not, as we all know that it is hard to imagine it but Coca-Cola did the same in 1982 when the company purchased Columbia Pictures to expand in the new line.

Not just this, there are various other examples for the unrelated diversification and another example is that of W. R. Grace and Company which is an American chemical company that is known for producing specialty chemicals and materials. However, W. R. Grace and Company also diversified in different products and markets by venturing into oil and gas extraction, food manufacturing, health services, coal mining, etc. The key reason for such a type of diversification is to diversify the business risks associated with the operations in a single line.

Types of diversification strategies

Till now, we have discussed the meaning of diversification and its kinds that are related and unrelated to diversification. But, have you ever studied the different strategies of diversification? There are different types of diversification strategies. Let us discuss them in detail.

Concentric diversification

Concentric diversification refers to the process of introducing new products or services similar to the existing products and services. Thus, the concentric strategy is part of the related diversification when the firm uses its existing brand image, customer base, resources, distribution channels, and skills to enter a new market or product segment. The concentric strategy also helps the business to attract new customers who have an interest in the existing products and are swayed by the new products. An example of concentric diversification is the launch of Tomato Ketchup and Sauce by Maggi.

Horizontal diversification

Diversifying business horizontally means introducing new products or services to the current offering with the aim to expand the market share. Horizontal diversification relates to the development of new products which are somewhat similar to the original lines. For example, JK Helene Curtis, a leading male grooming company launched Park Avenue’s premium range of perfumes enriched with 100 % perfume liquid in three distinct variants i.e. Icon, Magnifico, and Regal which shows that the grooming company launched perfumes to enter the new market with the new product.

Conglomerate diversification

Conglomerate diversification is just like unrelated diversification as it involves the development of new products unrelated to the original lines of the existing business. In this type of diversification strategy, the business enters a completely new market (new customers) that has had zero interest in the previous products or services of the company. The main benefits of conglomerate diversification are higher growth and higher return on investment as conglomerate diversification leads to the addition of new revenue streams in a totally new and separate market. A good example of conglomerate diversification is the expansion of Tesla into the space industry through the launch of the SpaceX Falcon Heavy rocket. This is the First Production Car that is launched into space and the First Production Car to orbit the sun.

Vertical diversification

Vertical diversification or vertical integration occurs when the company diversifies its product line through forward or backward integration of its products in the existing supply chain. The main aim of vertical diversification is to strengthen the business supply chain and cut down its production cost. The best example of vertical integration is IKEA as a company that bought 83000 acres of forests in Romania to secure its Timber supplies for making furniture. Through a backward integration strategy, IKEA focuses on managing its own forest operations and supply processes for Timber. IKEA also acquired an imaging startup i.e. Medical Labs in April 2020 that offers 3D supercharge room visualization which further helps to ensure a better customer service experience. This is the example of the forward integration of the company where the focus of IKEA is to ensure higher customer visualization which helps to effectively manage the supply system all over the world.

Best examples of diversification

Now, we have discussed types of diversification in detail. Let us take some good examples of the diversification strategies of the companies to help you understand in detail this business strategy.

An example of diversification- Siemens growth strategy

Siemens AG is a German Multinational Conglomerate Corporation that was incorporated in 1847 with the aim to manufacture Telegraph installations and other electrical equipment. However, over the period of time, the company has gone through huge diversification with the aim to increase its market share by getting new products in the market and ensuring higher customer satisfaction. The company has diversified its business in different ways i.e. related and unrelated diversification. Related diversification includes the expansion of products and services in a similar line of business. The related diversification of Siemens includes expansion in the field of building, communication, mobile solutions, lighting, and energy solutions. The unrelated diversification of Siemens includes expansion beyond its current scope and the industrial sector. Simmons collaborated with Fujitsu to enhance its competitive position in the market and accelerate digital transformation in the manufacturing industry. Fujitsu Siemens computer incorporation was established with the aim to offer computing devices, software, electronic devices, and communication networks to the customers.

An example of diversification- Diversification of Reliance industries

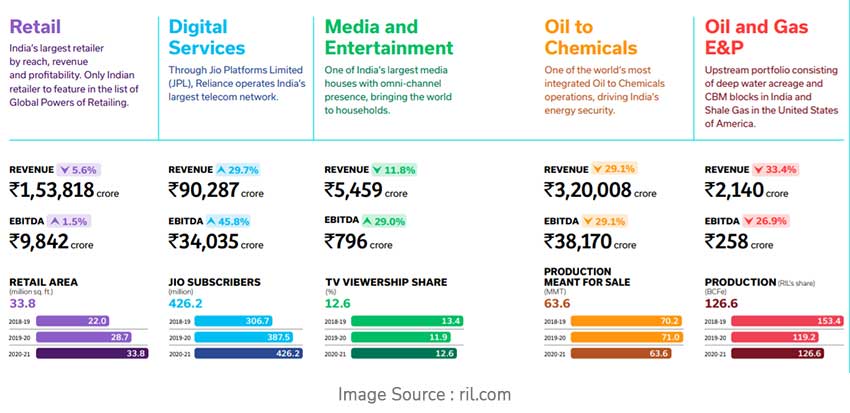

When it comes to evaluating the large-scale diversification of the organization, you need to look no further than the diversification of the Reliance Industries. Reliance Industries Limited is an Indian multinational conglomerate company that has expanded its product portfolio far beyond its textile and petro-chemical origins. Reliance Industries has established businesses in the field of energy, petrochemicals, mass media, textile, natural gas telecommunication, and retail. As per the annual report of the company, it is seen that the retail business of Reliance is expanding at a faster pace which is providing a huge competitive advantage to the company. The operating leading business of Reliance Industries is demonstrated as follows-

From the above-listed example, you must have seen that diversification strategy pays off to the company if the investment is made in the right areas. Diversification strategies helped Reliance Industries to ensure a higher return on investment and higher profitability by mitigating various risks to the overall portfolio.

An example of diversification - Diversification of SoftBank group

The other example of the diversification strategies is SoftBank group corporation which is a Japanese multinational conglomerate holding company that has it headquarter in Minato, Tokyo. The company primarily invests in the technology and financial sector. SoftBank Corporation was founded in 1981 as a telecommunications company that now has a hand in different areas or industries such as e-commerce, finance, broadband, marketing, and many more. The overall business portfolio of SoftBank includes SoftBank BB, IDC Frontier, SB Creative, Alibaba group, GungHo Online Entertainment, and many more. In July 2016, SoftBank also purchased the UK-based chip manufacturer to contribute towards the internet of things and in 2017, the company also announced its decision to buy the two robotic companies from Alphabet. This shows that the SoftBank Corporation has focused on both related and unrelated diversification strategies to expand its market share. SoftBank Corporation has developed multidimensional interests ranging from artificial intelligence to computerized enhancement as well as Robotics 2 satellite.

From the above analysis, it is clear that diversification is an important strategy that is adopted by business firms to mitigate their risks in different areas and to expand their market share. Now, let us discuss the need for diversification in detail.

Need for diversification

Till now, we have discussed the different types of diversification strategies but now we need to discuss some of the major reasons for the diversification of the organizations.

Businesses diversity for risk mitigation

One of the main reasons for the diversification strategy is to mitigate risk as the business operates in the VUCA (volatility, uncertainty, complexity and ambiguity) world and in times of market volatility, businesses are required to introduce more products to diversify their risk. The diversification of the business in different product lines or various industries helps to separate their risk across multiple channels and loss of sales in one channel due to market volatility does not result in a downturn of the whole business. Hence, the organizations diversify to mitigate the unsystematic risk which refers to the risk in the specific market. For example, various Fashion and Beauty houses such as LVMH and Coty changed their product lines to health care products such as hand sanitizer and face marks during the COVID-19 period to deal with the market volatility and unsystematic risk posed by COVID-19.

Businesses diversity to increase profits

We all know that businesses diversify to increase their profit margins through the addition of new revenue streams. Diversification also helps businesses to leverage their existing resources, competencies, brand image, and customer base while entering the new products or new markets which further helps to increase the profit margins of the company.

Despite the need to mitigate risk, Starbucks also diversified into the food menu to grow its sales and profit margins. The new food range has become an important source of income for Starbucks as the food menu helps to increase the spending per customer in the store.

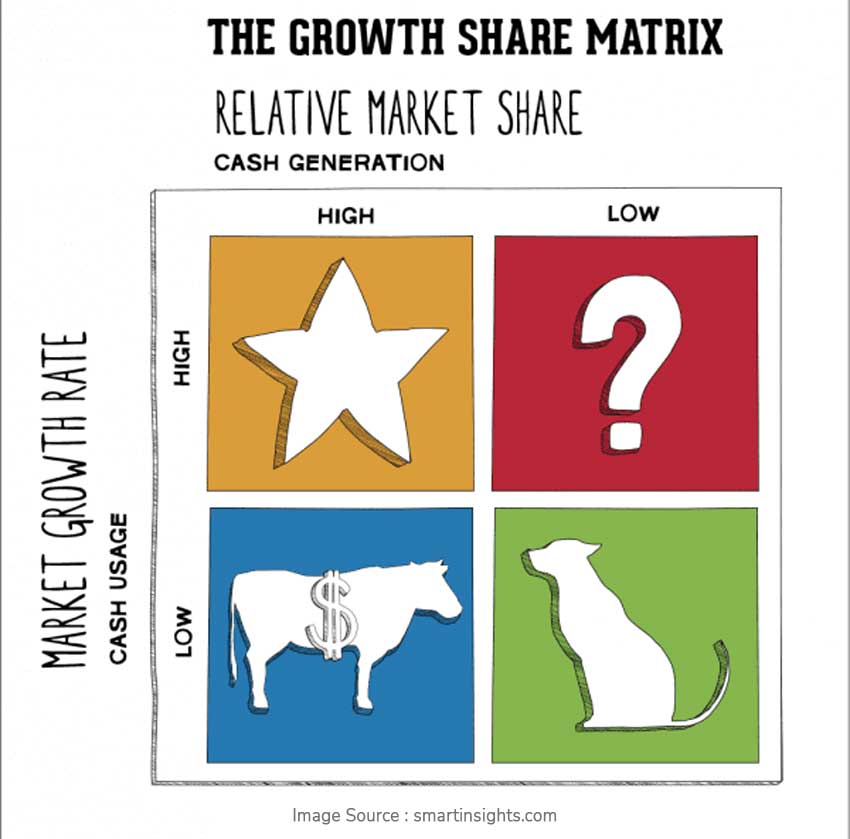

Besides this, we also need to consider that there may be important opportunities for an organization to achieve higher revenue and profits with little investment by diversifying its operations. The BCG Matrix is an important planning tool that can be used by the organization to evaluate the products and services of the other firms and to decide where the organization should invest.

The matrix can help an organization to categorize the products of the competition or the other firm into different categories which include Dogs, Cash Cows, Stars, and Question Marks. This can help the company to evaluate the growth rate and the market share of different products and services in the industry which further can help the company to take the diversification decision to improve its market share and market growth.

Furthermore, the organizations may decide to enter the areas that require little investment and can provide higher profitability to the organization.

Businesses diversify to ease competition

The businesses may also diversify in the case of a highly competitive business environment. The companies may also work or collaborate with the competitor firms to diversify their operations and to protect their business from various risks and competitive pressures. In this diversification strategy, the company may take out the competition and share its profits. Moreover, the businesses may also diversify into other sectors or industries when there is huge competitive pressure in one sector.

Decision-making factors for diversification

Now, you must have understood the importance and need for diversification. Do you know how organizations decide that diversification is the right growth strategy for the business? Diversification may not be a good strategy for every company or business. Thus, we need to consider the factors that should be considered by each firm while diversifying their operations.

Resources

We all know that resources are crucial to the success of a business. It is always best to determine the resources and competencies of the organization while entering an industry. The resources can be defined as the economic factors required to achieve the desired outcomes. Are resources considered only at the time of starting a new business? Obviously no! The businesses are required to consider various resources as well as the skill and competencies of the employees while diversifying the business. It is only through the right employees that the business can scale new heights and attain success in the new markets. Moving further, a business is also required to consider the financial resources as well as the assets of the organization while expanding into the new product line or the market. Further, the availability of the needed assets and resources is one of the key factors that influence the organization to diversify into the new business line. In order to ensure that the assets and resources are aligned with the strategic goals of the business at all times, companies can implement the strategic alignment model at regular intervals. This strategic planning model will be of great use for the top management to manage the company’s resources and competencies in a way that is conducive to growth.

Know how

The available technical competencies of the organization are one of the other major factors that are considered by the organization while diversifying the business. The organization may have all the technical competencies needed to enter the new product in the market segment or may not have the needed technical competencies which play an important role in an organization’s decision to diversify. To diversify, the organization needs to have all the technical competencies needed and not just some of them. Organizations also need to consider if the technical competencies or know-how can be transportable to the other industry where the organization wants to diversify.

Competitor analysis

While diversifying, the business organization also needs to consider its own competitive position as well as the competitive position of the industry where the organization wants to diversify. The organization also needs to consider if the company can perform better than any of its competitors in the current market while diversifying the business. The first step in diversifying into a new market or product segment is to evaluate the competitive position in the industry and the competitive strength of the organization. Organizations not only need to decide what the organization is doing but also need to consider what the competitors in the industry are doing. Furthermore, Nokia also failed in the mobile segment despite its unrivaled dominance due to a lack of consideration of the competitive position of the other firms in the industry.

Economic analysis

Economic analysis can also be done by the organization before entering the new market as economic analysis of industry can help the organization to determine the growth rate as well as the future growth opportunities in the industry. The economic analysis can also help to determine the feasibility of entering into the new market or the product line which also can help the organization to make the best decision.

From the above analysis, it is seen that diversification decisions are not taken through a roll of dice as the diversification decisions are required to be taken by considering various factors. While taking the diversification decision, the organization also needs to consider how diversification in new products or the market segment can add value to the company. Thus, it is seen that the managers need to perform the proper market analysis while taking the diversification decisions and deciding the type of diversification strategy to be adopted is another main decision taken by the company.